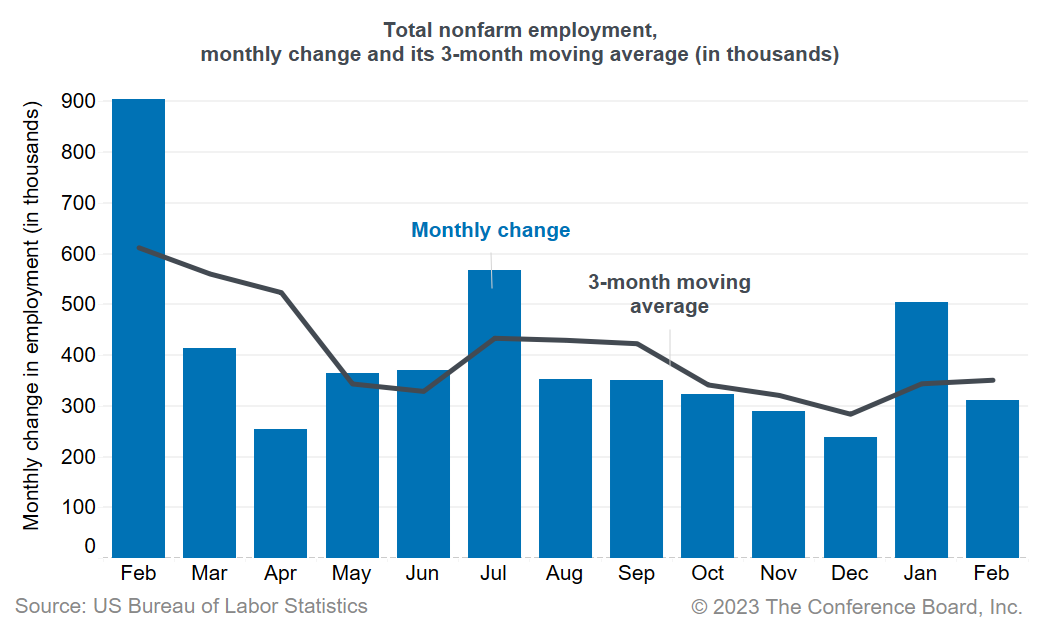

US labor markets remained resilient in February despite continued recession expectations. Although layoffs are picking up in some pockets of the economy, robust job gains overall, labor shortages, and persistently elevated wages, all bode unfavorably for slowing inflation. Hence, these data underpin the Fed’s continued hawkish stance and raise the probability of faster and potentially larger interest rate hikes ahead. Strong job growth continued in February, with 311,000 jobs added in February 2023, after an increase of 504,000 jobs (a downward revision) in January. The unemployment rate rose to 3.6 percent from 3.4 percent in January. The labor force participation rate increased slightly from 62.4 percent in January to 62.5 percent. The employment-to-population ratio for prime-age workers (25-54) is now back to its prepandemic level at 80.5 percent. Average hourly earnings growth in February grew to 4.6 percent year over year, from 4.4 percent in January, remaining elevated compared to pre-pandemic trends but still lower than the peak reached in March 2022. At the sectoral level, leisure and hospitality (105,000), health care and social assistance (62,800), and retail trade (50,100) added the most jobs. Together, they are responsible for nearly 57 percent of job gains over the last three months. These in-person service industries have been facing the most challenging labor shortages. For leisure and hospitality and health care, hiring is expected to continue even with a downturn in the economy. Other industries that recorded significant job gains included government (46,000), professional and business services (45,000), and construction (24,000). While the construction industry keeps adding jobs, job openings in the sector fell by half between December and January, an early sign that construction jobs growth may slow in coming months. The large net gain in employment notwithstanding, cracks in the labor force are forming. Information services, which include tech companies, lost 25,000 jobs as layoffs continue in the industry. Over the last three months, the industry recorded a total of 54,000 job losses. Year- over- year, average hourly wages in the industry, at 5.5 percent, declined for a sixth consecutive month. Finance and insurance lost 10,000 jobs in February and recorded layoffs in three out of the last four months. Transportation and warehousing lost 21,500 jobs. The industry grew rapidly during the pandemic but now as consumers shift their consumption towards services and away from goods, hiring is expected to continue slowing. Employment in manufacturing continued its downward trend and lost 4,000 jobs in February. Temporary help services—a leading indicator for hiring—added a modest 6,800 jobs. While labor shortages persist, with job openings remaining above historic levels, and layoffs below prepandemic levels, we see a clear shift in hiring away from industries that grew rapidly during the pandemic lockdowns towards in- person service industries that did not fully recover from pandemic job losses.

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023