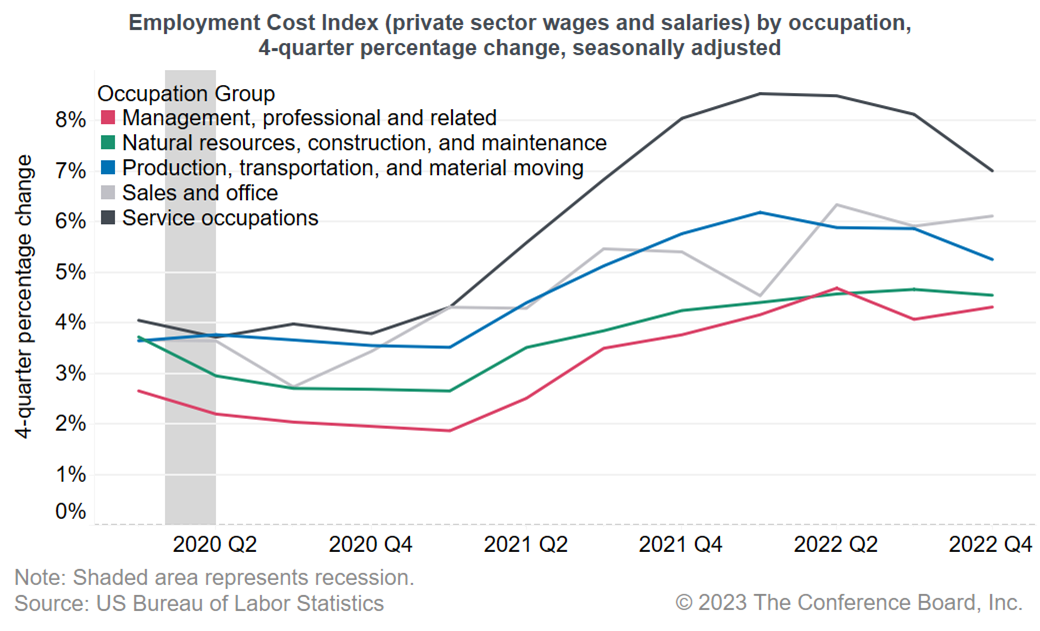

COMMENTARY ON TODAY’S U.S. BUREAU OF LABOR STATISTICS EMPLOYMENT COST INDEX Today’s compensation report showed that wages and benefits continued to grow in the fourth quarter of 2022 – albeit at a slower rate compared to earlier in the year. Compensation for private industry workers grew by 5.1 percent over the past year, which was down from 5.2 percent in the third quarter and 5.5 percent in the second quarter. Benefit costs grew by 4.8 percent compared to 5.0 percent in the third quarter and 5.2 percent in the second quarter. Wages rose fastest for occupations facing the greatest labor shortages. Wages for in-person service workers (including food services, cleaning, and personal care) grew by 7.0 percent over the last year while wages for transportation and production workers grew by 5.3 percent. Wages increased by 6.1 percent for sales and office workers, 4.6 percent for construction, natural resource, and maintenance workers, and 4.3 percent for management and professional workers. We are seeing some signs of deceleration in the demand for labor and wages. The quits rate overall (3 percent) is below its historic high (3.4 percent) observed at the end of 2021 and is back to its prepandemic level for the information sector (which includes most tech companies) as well as construction. Workers receive larger raises when they switch jobs, meaning wages are expected to grow slower as the quits rate falls and fewer workers move to new jobs. We see the impact in this report, with wage and benefits growth declining compared to the previous two quarters. Decline in compensation growth might lower inflation expectations as wage increases can ultimately cause price increases. We expect the demand for labor will decline in 2023 as a recession seems imminent. However, we project that the impact of an upcoming recession on labor markets will be limited, with the unemployment rate rising to 4.5 percent by the end of 2023, much lower than the peaks in previous recessions. We expect that wage growth will further decelerate as a result of weakening labor markets in 2023. While the peak in wage growth seems to be behind us, we don’t expect the wage growth rate to go down to pre-pandemic levels as labor shortages will persist due to demographic changes, including an aging population and declining immigration. US CEOs name labor shortages as one of the top three factors that will have the greatest impact on their businesses in 2023 according to The Conference Board C-Suite Outlook. Attracting and retaining talent is the second highest priority that they plan to focus on. Nearly 85% of CEOs expect to increase wages by 3% or more over the next year according to The Conference Board CEO Confidence Survey suggesting that wage growth will continue to be stronger than the last decade when it hovered between 2 to 3 percent.

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023