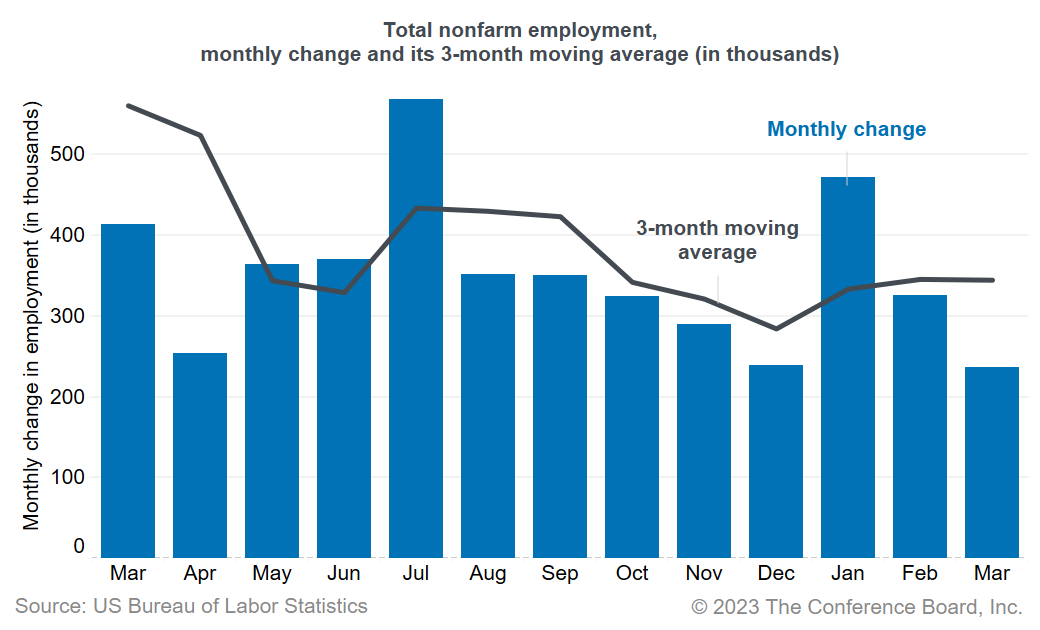

The US labor market has shown continued strength so far in 2023. Today’s jobs report revealed another robust gain in employment, with 236,000 jobs added in March, following an increase of 326,000 (an upward revision) in February. Labor shortages remain the main challenge for employers and layoffs are still low, although in some pockets of the economy cracks are appearing. Wage growth has decelerated from a year ago, but at 4.2 percent growth over the past 12 months it remains well above its prepandemic rate. With inflation also still elevated, and the worst of the banking crisis likely over, we expect the Federal Reserve to raise interest rates two more times by 25 basis points each. The unemployment rate remains historically low, ticking down to 3.5 percent in March, from 3.6 percent last month. Labor-force participation increased slightly, rising to 62.6 percent from 62.5 percent in February. Continuing improvement in the participation rate will alleviate some of the hiring difficulties. Strong job gains were reported again in leisure and hospitality (72,000) and health care and social assistance (50,800), the two sectors which have been driving employment growth over the last few months. Other notable gains were reported in government (47,000) and professional and business services (39,000). While the labor market remains strong overall, some industries are showing signs of weakness. Although the information sector—which is tech-heavy—reported a small increase in employment in March (6,000), the sector was shedding jobs between November and February and its downward trend may resume over the next months. Employment in transportation and warehousing increased in March (10,400), but has been moving sideways since October. Temporary help services employment—a leading indicator for job growth—dropped by 10,700 in March. Even though the industry grew over the prior two months, the temp services sector now stands at 94,200 jobs below its level from last October. A short and shallow recession remains our most likely scenario for the US economy in 2023. While the labor market is robust today, we project the unemployment rate to rise to 4.5 percent by Q1 2024 with job losses to total 1.1 million, likely starting in the second half of 2023 and to continue into early 2024. However, we expect job losses to vary widely by industry. Indeed, according to The Conference Board Job Loss Risk Index—a new analysis which measures the likelihood of layoffs across the economy—industries that face the greatest risk of layoffs this year include information services, transportation and warehousing, and construction. Meanwhile, sectors including government, private education services, health care, and accommodation and food services may be the least at risk. Exposure to labor shortages is one of the main factors in the Index. Severe labor shortages in a particular industry will likely make employers especially careful about laying off workers, to avoid facing renewed hiring difficulties after a downturn ends.Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Charts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORECharts

Members of The Conference Board can access all underlying data of the Job Loss Risk Index by Industry in this Excel workbook.

LEARN MORECharts

While a US recession appears to be imminent, it will not look like any other in recent history.

LEARN MORECharts

CEOs’ views of current and future economic conditions remain pessimistic as they prepare for near-inevitable US and EU recessions.

LEARN MORECharts

The US economy appears to be on the precipice of recession.

LEARN MORECharts

Measure of CEO Confidence declined for the fifth consecutive quarter in Q3 2022 and has hit lows not seen since the start of the COVID-19 pandemic in 2020.

LEARN MOREPRESS RELEASE

Survey: In 2024, CEOs Are Most Worried About a Recession & Inflation, But S…

January 10, 2024

PRESS RELEASE

As Labor Day Approaches, HR Leaders Say Hiring

August 29, 2023

IN THE NEWS

CEOs Are Predicting a Mild Recession in the U.S.

June 01, 2023

PRESS RELEASE

Global Productivity Growth Set to Disappoint Again in 2023

May 17, 2023

IN THE NEWS

Dana Peterson on Why Recession is Likely in 2023

April 20, 2023

PRESS RELEASE

Which Industries Will Start Shedding Jobs?

April 05, 2023